Daring Fireball wrote about the Apple GPT news. I think the news itself is pretty uninteresting: Apple wants in on the ChatGPT gold-rush even as it seems to be winding down. The more interesting part is what he writes about Bloomberg:

Bloomberg reporters are evaluated and receive bonuses tied to reporting market-moving news. They’re incentivized financially to make mountains out of molehills, and craters out of divots, to maximize the immediate effect of their reporting on stock prices. And Bloomberg appends these stock price movements right there in their reports, to drive home the notion that Bloomberg publishes market-moving news, so maybe you too should spend over $2,000 per month on a Bloomberg Terminal so that you can receive news reports from Bloomberg minutes before the general public, and buy, sell, and short stocks based on that news.

…

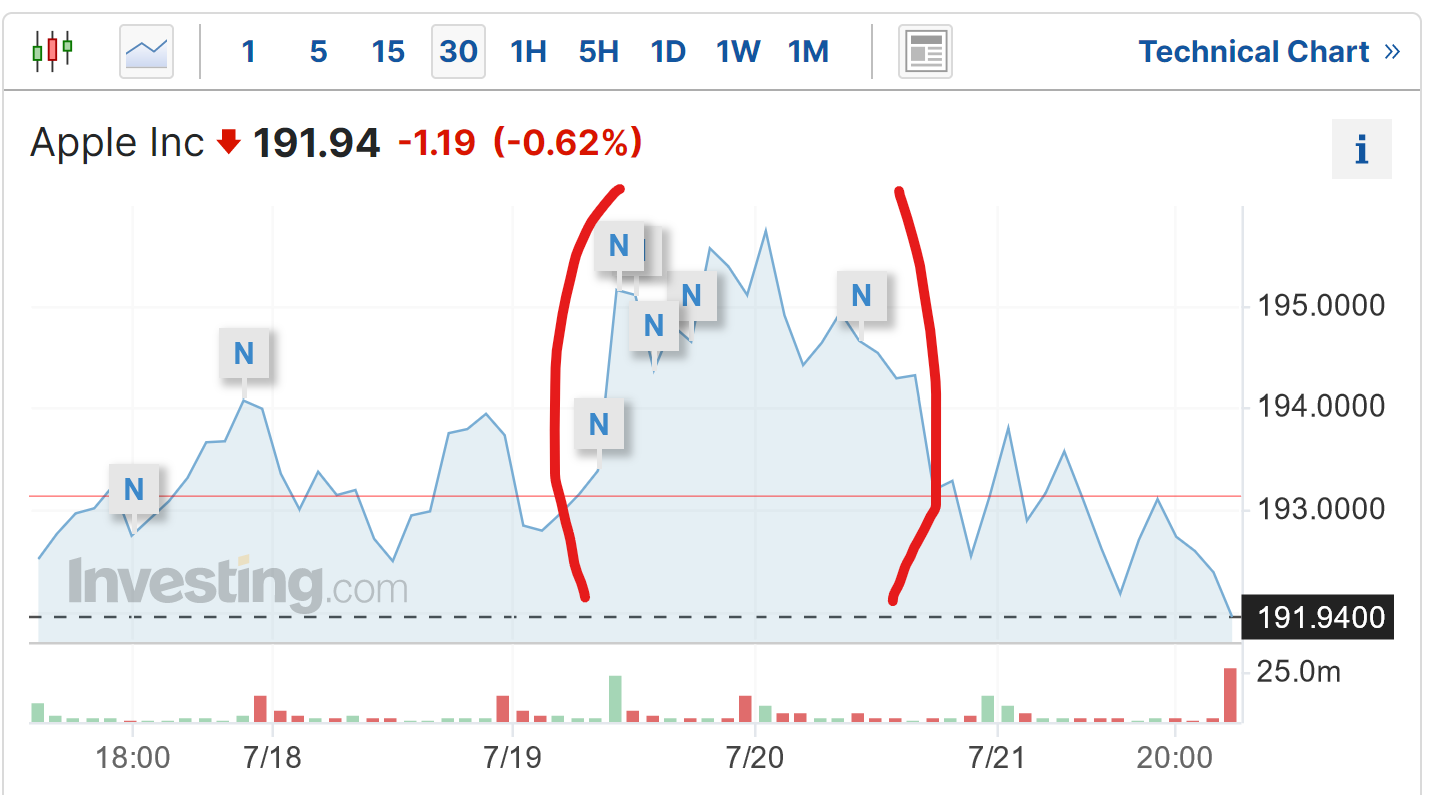

Apple’s brief 2.7 percent jump and Microsoft’s smaller but still-significant drop, both at 12:04pm, were clearly caused by Gurman’s report. Bloomberg Terminal subscribers get such reports before anyone else. […] most of their original reporting is delivered with the goal of moving the stock prices of the companies they’re reporting on, for the purpose of proving the value of a Bloomberg Terminal’s hefty subscription fee to day-trading gamblers […]

Tinfoil hat time? I mean… that’s quite the stretch. Even if Bloomberg doesn’t report particular news, a million other websites will; how does Bloomberg move the market in particular? Bloomberg is hardly the only company selling ahead-of-the-crowd services; it’s obviously a lucrative thing to do successfully, given the herd mentality that all markets follow1. They obviously want to communicate news that have the potential of moving stocks, otherwise they’d not be a good source of finance news!

As for making mountains out of molehills, I think that’s a fair criticism to an extent, but it’s also not one that is in any way unique to Bloomberg. Clickbait and blowing news out of proportion is just business as usual for mass media these days, thanks to the advertising industry financing a large chunk of websites and competition fierce enough to trigger a race to the bottom with low-effort reporting. My personal impression is that Bloomberg is actually better than many in this regard.

By the way, the Apple stock stayed up after these news (see the Investing.com chart), only dropping back to previous levels some 24 hours later when manufacturing issues were reported with the upcoming iPhone 15. So it was good reporting by Bloomberg.

-

Predicting how a market will move though is pretty much hopeless in the general case, as financial markets are a good example of a chaotic system in that it responds not just to events, but predictions and expectations as well, and does so in a recursive, self-predicting way: if enough people think that upon some news others will want to buy a particular stock, then the stock will move on the news. This is one of the factors that makes markets very “noisy”: prices move very frequently, even for large, fairly stable stocks. ↩︎